Orchard Funding Group PLC

A deeply discounted security trading at 49% of net current asset value with catalysts.

Disclaimer: Nothing in this article constitutes investment advice. The business presented here is highly illiquid; invest at your own risk.

Quick Notes

Orchard is up 33% today based on 2024 H1 disclosures - time got away from me as I meant to publish this writeup in advance of this event. Numbers below have been updated accordingly.

On a net current asset value basis, Orchard is still a dislocated left-for-dead UK nanocap selling for 49 pence on the pound.

Over the past 5 years, Orchard has annually paid a 14% dividend based on the current market price.

CEO Ravi Takhar owns 54.19% of shares outstanding. Well incentivized to right the ship.

At 21 pence per share, market cap is 4.5m GBP. Tiny.

Recent events have seen it left for dead by the market, but these events are short term in nature and the business is not permanently impaired - H1 disclosures from today, April 9th, 2024, confirm this.

Business Overview

Orchard Funding Group PLC is small finance business, specializing in the professional fee funding and the insurance premium market in the UK. Clients of professional services firms choose fee funding to better manage their cash flows by borrowing from Orchard, who will pay their invoices up front, then collect their debt in instalments over the year. Fees are often tax deductible.

Insurance premium funding is similar, giving businesses the ability to pay their insurance premiums in regular instalments, rather than in one large lump sum payment.

Orchard also provides holiday, private school and leisure fee funding, which is usually 100% backed by agreements with the sellers themselves.

Orchard operates a "hold to collect" model in which financial assets are held to maturity to collect cash flows of principal and interest, rather than holding them for sale. Loan duration is typically annual.

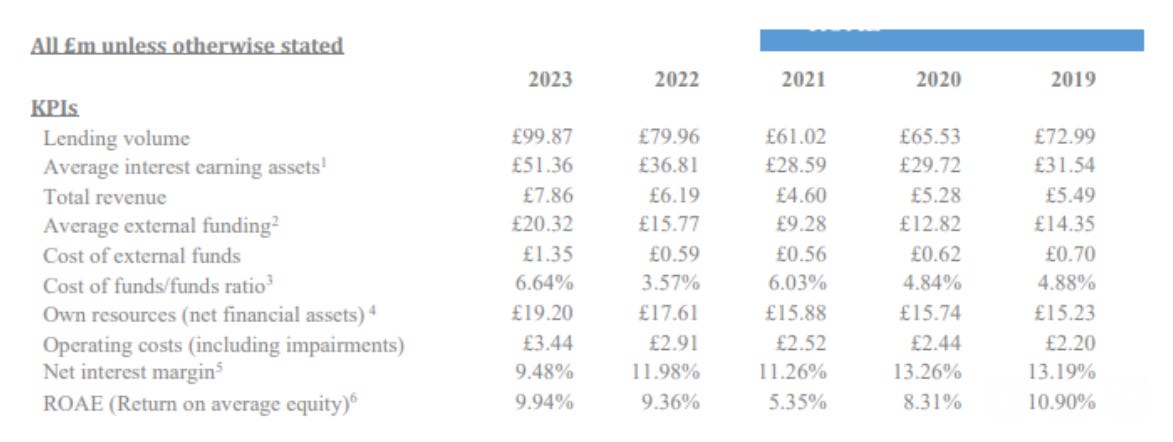

Orchard is a growing business, having grown its lending book considerably in 2023.

Rather than go into further details of Orchard’s medium to long term prospects, please see Tristan’s pitch here, who has provided a concise overview of the firm.

Credit ultimately belongs to Tristan for bringing this business to my attention. He is an outstanding investor and a continuous source of excellent ideas. I decided to do this writeup given the new short-term events that have impacted the share price significantly.

Why this Opportunity Exists

Three recent developments have heavily impacted the share price.

The first, involves a recent intervention from the UK’s Financial Conduct Authority on the GAP insurance market.

On February 2nd, Orchard announced that “a number of insurers are withdrawing products from the guaranteed asset protection ("GAP") insurance market. GAP insurance is sold as an add-on to motor insurance, covering the difference between a vehicle's purchase price and its current market value.”

This action followed findings from the FCA’s latest fair value measures data, which showed that only 6% of the amount customers pay in premiums for GAP insurance was paid out in claims. The FCA noted some examples of some firms paying out 70% of the value of insurance premiums in commission to parties involved in selling GAP policies, hence not all bad. You can read more about it here.

GAP insurance was clearly an inferior product offering little benefit to most consumers. The FCA intervention appears justified. This a significant hit to Orchard’s overall market, reducing it immediately by “over 20%.” Orchard will be made whole on the funds it lent, but it will need time to seek out new markets to lend the impacted over 20% of its assets.

Orchard will have some soul searching to do in terms of addressing the quality of its insurance funding product mix, but this is hardly a Sisyphean task. With time, Orchard will be able to identify new market opportunities and new introducers with which to lend these funds.

The second, counterparty fraud. On March 1st, 2024, Orchard announced that it had suffered an instance of fraud, arising from dealings with a fraudulent introducer and fraudulent credit agreements funded by the Company as a result. The company has set aside 500K as a provision.

This raises concerns about the quality of Orchard’s introducer network and the vetting of these agents. 500K is material to Orchard given their small size but some of this may be recoverable with time. On April 9th, 2024, Orchard announced that the fraud was isolated and does not impact any of their other assets.

The third and final development involves a major shareholder disposing his shares. Per recent disclosures, Stuart Hawthorne began divesting his position prior to the emergence of the news above. Mr. Hawthorne once owned over 7% of the company but has been consistently selling since January 2024. While this is rarely a good sign, I believe that the stock has been oversold and the market unable to absorb Mr. Hawthorne’s divestment in good order. Hence our opportunity.

Investors have innumerable reasons to sell, but only one reason to buy. Altogether, the confluence of these events has resulted in an extraordinary opportunity buy a business at steep discount to its intrinsic value.

Napkin Math: From Tangible Book Value to Net Current Asset Value

All values in GBP unless stated otherwise. Values from 2023 FY.

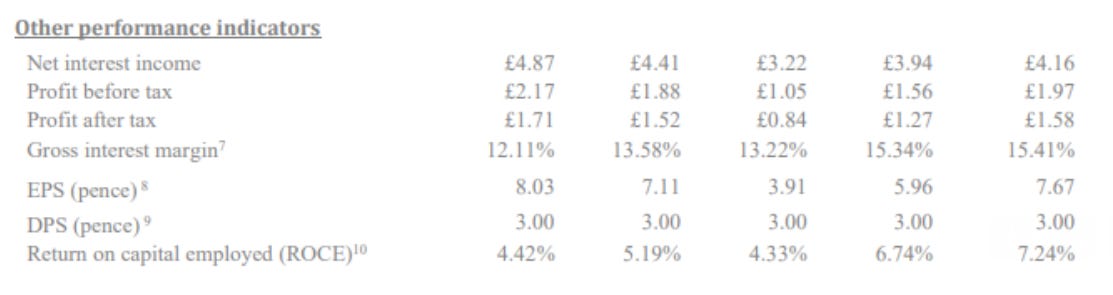

First, consider the tangible book value below:

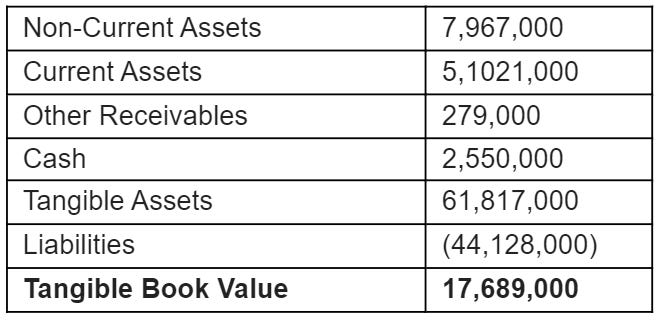

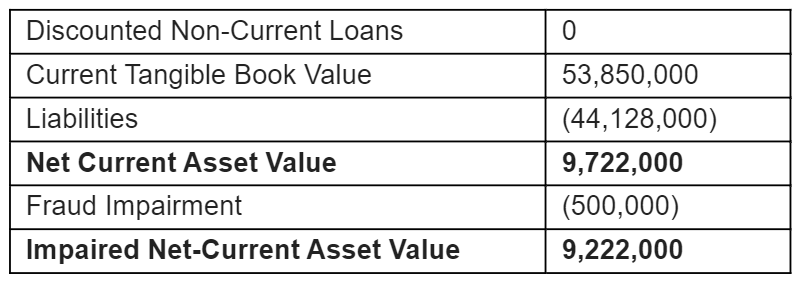

Next, lets subtract non-current assets to arrive at NCAV.

Divide current market cap (4,500,000) by Impaired-NCAV and arrive at your destination, 49 pence on the pound or 49% of Impaired NCAV.

How’s that for a margin of safety?

Return on Investment

Impaired-NCAV implies value of 43 GBX per share, or a total return of 105% from here.

21,354,167 total shares outstanding. No options or convertibles exist to dilute current shareholders.

Should it trade at a premium to NCAV? Tangible book value is approximately 83 pence per share per recent H1 disclosures.

The market has historically discounted this stock below its TBV/S but the future is uncertain. With time, proof of business continuity, more dividends, growth, or a decrease in the prime rate could see a significant re-rating, however, until then, I believe NCAV is the best short term valuation method suited to this opportunity.

Quality concerns are justified. But I think it’s difficult to lose money at current prices whereas the probability of an outsized return in a relatively short period is significant.

Orchard probably shouldn’t be publicly traded – its too small to draw much investor interest and as such, may continue to trade at a deep discount to its intrinsic value for the near term. I’ve chosen to disregard Orchard’s intrinsic value because of these concerns, but recognize that this provides strong optionality should the business overcome these recent events and resume growing.

H1 Results and Upcoming Catalysts

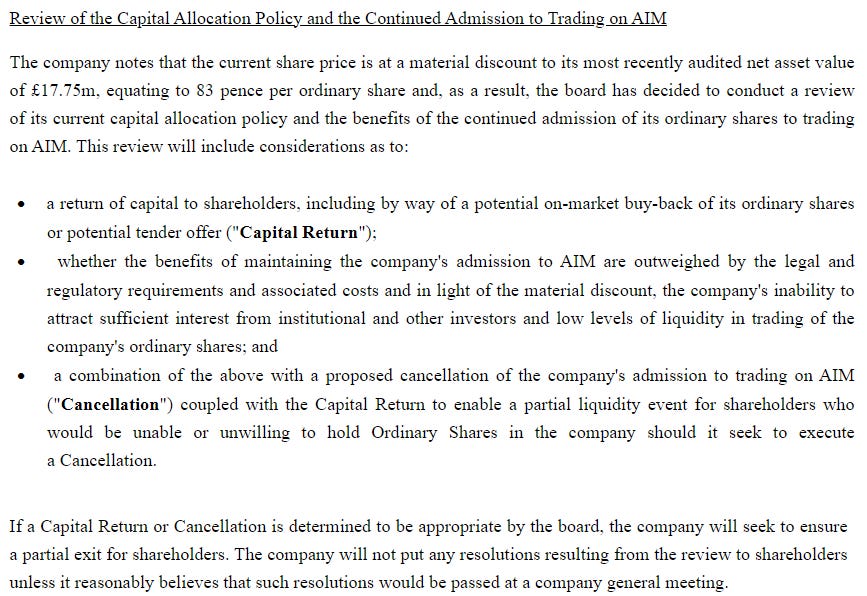

On April 9th, Orchard released its H1 results, with a particular emphasis on the company’s capital allocation policy and discount to net asset value.

Altogether, this points to an extremely probable realization of a positive windfall for shareholders at very low risk of permanent capital impairment from current prices.

Orchard is a nanocap and is highly illiquid. I am long Orchard. Nothing written here constitutes investment advice.

Hi Luc,

Great job writing up Orchard.

Feel free to reach out via. DM on X, would love to chat more about it.

Tristan

Anything new regarding the ORCH?